Below are various transaction types performed in Idealpos one at a time then sent to Xero as individual Journals.

We’ve tested each transaction with Accruals and Cash Based GST Accounting Methods.

The Cash Based Journals are sent to a Customer in Xero called ‘Cash Debtor’.

The Accrual Based Journals are sent to a Customer in Xero called ‘Accruals Debtor’.

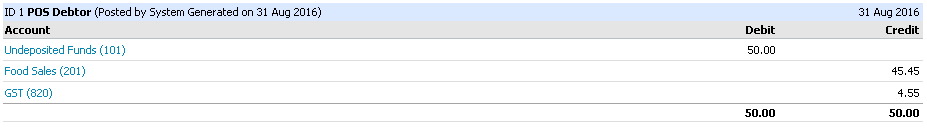

A Sale for $50.00 Inclusive of GST - paid by Cash.

A Sale for $50.00 Inclusive of GST and $50.00 Exclusive of GST - paid by Cash.

A Refund of $10 Beverage and a $10 Sale of Food.

A Sale for $50. $25 paid on Cash and $25 paid on EFTPOS.

A Sale for $50.00 Inclusive of GST with a cash-out amount of $10.00.

A Sale for $19.97 Inclusive of GST with 2c Rounding as it was paid by Cash.

Several Sales totalling $100 in the End of Shift and a Variance of $5 entered as the Cash was less than expected.

A $50 Sale was saved to a Bar Tab then paid with Cash.

A Customer Opened a Bar Tab and want to Pre Pay $500.

Accumulated Sales totalling $500 were saved to this Bar Tab. When paid, the pre-paid amount of $500 was applied to the sale.

A Cash Refund for $50.00 Inclusive of GST.

A Refund on a $50 item and issued $25 Cash and $25 EFTPOS to the customer.

A Refund on a $50 item and issue a Credit Note.

A Sale of $50 paid with a Credit Note of $50.

A Cash Void Mode Transaction for $50.00 Inclusive of GST and $50.00 Exclusive of GST.

Using the RA and PO Functions for Tips in and Out does not record GST. If you wish to record GST on Tip that have been collected, we recommend using a Stock Item with GST set.

A $10 Tip has been entered and tendered on Cash.

A $10 Tip has been taken out and tendered on Cash.

A $20 Paid in has been entered and tendered on Cash.

A $20 Paid Out transaction tendered on Cash.

A Gift Voucher Sale of $100 paid by Cash.

A Sale of $100 paid by Gift Voucher.

A Gift Voucher Sale of $100 paid on Account.

A Gift Voucher Sale of $100 paid by Points.

No Journal is sent to Xero.

Sale of $50 Inclusive of GST and $50 Exclusive of GST tendered on Account.

A part payment of $50 on was applied on Account.

A final payment of $50 on was applied on Account.

An Unallocated Payment of $50 Inclusive of GST tendered on Account.

You cannot do an overpayment on an Account when using the Xero Interface.

Example!

If a customer has an invoice owing of $50 and they pay $60, you cannot apply a $60 payment in a single transaction.

Instead, you will need to pay the $50 invoice.

And in a separate transaction, do an unallocated payment of $10 which will put the account in credit.

Debit Adjustments are blocked when using the Xero Interface. An example of where it may be required is when a customer has a credit on their account, and the owner wishes to clear the credit and put their balance to zero.

Rather than do a Debit Adjustment, we suggest you clear the credit balance by entering the credit amount through an open stock item as you would when you do a sale.

A Credit Adjustment can be performed to adjust an owing balance on an Account.

Sale of $50 Inclusive of GST and $50 Exclusive of GST tendered on Account.

A part payment of $50 on was applied on Account.

A final payment of $50 on was applied on Account.

An Unallocated Payment of $50 Inclusive of GST tendered on Account. Note that the GST has not been collected.

Debit Adjustments are blocked when using the Xero Interface. An example of where it may be required is when a customer has a credit on their account, and the owner wishes to clear the credit and put their balance to zero.

A Credit Adjustment can be performed to adjust an owing balance on an Account.

You cannot do an overpayment on an Account when using the Xero Interface.

Example!

If a customer has an invoice owing of $50 and they pay $60, you cannot apply a $60 payment in a single transaction.

Instead, you will need to pay the $50 invoice.

And in a separate transaction, do an unallocated payment of $10 which will put the account in credit.